Cultivated meat is reshaping the food industry. It's real meat grown from animal cells in bioreactors, offering the same taste and nutrition without large-scale farming. This collaboration between food and tech companies is driving down costs, improving production methods, and bringing cultivated meat closer to supermarket shelves.

Key points:

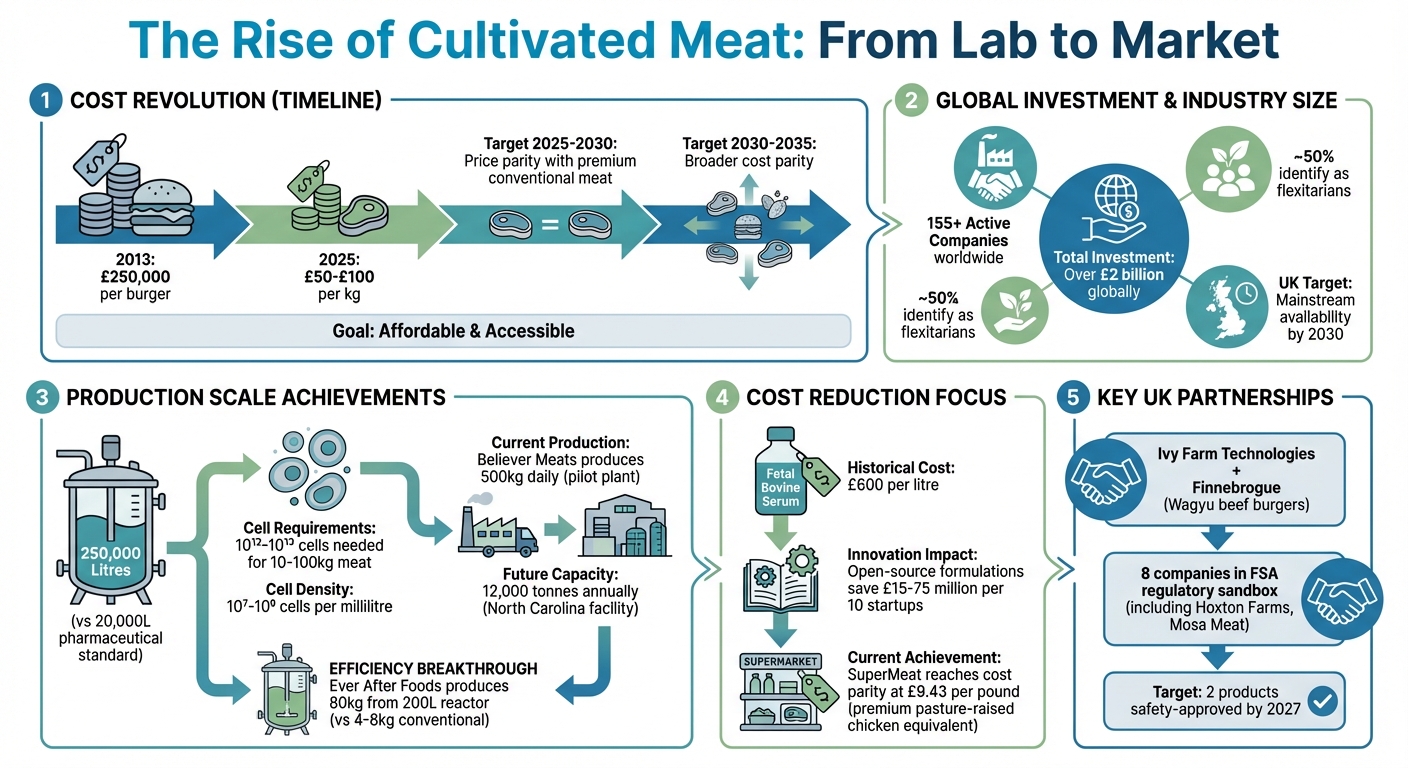

- Cost reduction: From £250,000 per burger (2013) to £50–£100/kg today.

- Major partnerships: UK-based Finnebrogue and Ivy Farm created cultivated wagyu beef burgers.

- Tech innovations: Bioreactors now hold up to 250,000 litres, enabling large-scale production.

- Animal-free growth media: Replacing costly Fetal Bovine Serum with plant-based alternatives.

- Consumer focus: Food companies enhance taste, texture, and affordability, making cultivated meat more appealing.

With over £2 billion invested globally and 155+ active companies, cultivated meat is on track to become a mainstream option in the UK by 2030. Partnerships are solving production challenges, while consumer education ensures market readiness.

Cultivated Meat Industry Growth: Cost Reduction, Investment & Production Scale 2013-2030

The future of meat? Inside the Oxford-based startup turning cells into 'steaks'

Technology's Role in Cultivated Meat Production

Producing cultivated meat involves highly specialised tools and carefully controlled environments. At the heart of this process are bioreactors, which act as industrial growth chambers, and growth media, which provide the necessary nutrients for cells to thrive and multiply. Together, these technologies form the cornerstone of commercial cultivated meat production.

Engineering expertise plays a crucial role in scaling these systems. For instance, tech companies are developing bioreactors capable of holding up to 250,000 litres while maintaining precise conditions, such as temperatures around 37°C, controlled oxygen levels, and minimal mechanical stress. Similarly, innovations in animal-free growth media are helping to make production more efficient and scalable.

Bioreactors and Commercial Production

Bioreactors are designed to replicate the conditions found inside an animal's body. These systems manage key factors like oxygen supply, carbon dioxide removal, temperature stability, and gentle mixing to ensure nutrients are evenly distributed. To produce 10–100 kg of cultivated meat, an estimated 10¹²–10¹³ cells are required, with bioreactors supporting cell densities of 10⁷ to 10⁸ cells per millilitre [8][9].

Different production methods cater to varying needs. Batch systems grow cells in a closed environment until they are harvested, while perfusion systems continuously refresh the growth media, retaining cells for higher productivity. With bioreactor designs now reaching capacities of up to 250,000 litres - far surpassing the 20,000-litre tanks typically used in pharmaceutical manufacturing - the industry is inching closer to large-scale production [8][9].

In May 2022, GoodMeat revealed plans for a facility with 10 bioreactors, each capable of holding 250,000 litres, which would make it the largest cultivated meat production site globally [8]. Meanwhile, researchers at the University of Tokyo, led by Professor Shoji Takeuchi, achieved a breakthrough in April 2025 by producing a 10-gram piece of whole-cut cultured chicken using a hollow fibre bioreactor. This system used 1,125 semipermeable fibres to ensure nutrients were evenly delivered [10].

These advancements in bioreactor technology are complemented by innovations in nutrient development.

Developing Animal-Free Growth Media

Growth media, the nutrient-rich liquid that sustains cells, is another essential component of cultivated meat production. It contains a mix of amino acids, vitamins, glucose, salts, and growth factors - molecules that guide cells to multiply and differentiate into muscle or fat tissue [11][5]. Historically, this media relied on Fetal Bovine Serum (FBS), a costly ingredient priced at up to £600 per litre, which also raises ethical concerns [14].

Replacing FBS with animal-free alternatives is critical for reducing costs and meeting ethical and regulatory standards. Researchers and companies are now focusing on recombinant proteins and plant-based nutrients as substitutes. However, this shift is resource-intensive; developing commercial cell lines optimised for serum-free conditions can take years and cost tens of millions of pounds [12].

In October 2025, the Good Food Institute (GFI) acquired bovine cell lines and serum-free media formulations from the now-closed SCiFi Foods. Collaborating with the Tufts University Center for Cellular Agriculture (TUCCA), they made these formulations open-source, allowing researchers to bypass years of costly development [12].

"When labs across the field have access to shared, scalable, and serum-free systems, I think it will cause a real leap in the value and applicability of their research." – Dr Andrew Stout, Assistant Professor, Tufts University Center for Cellular Agriculture [12]

This open-source approach is expected to save startups between £15 million and £75 million for every 10 companies by eliminating redundant research efforts [12]. Sharing knowledge in this way accelerates progress across the industry, making cultivated meat production more accessible and achievable on a larger scale.

What Food Companies Bring to Cultivated Meat

While tech firms are experts in growing cells in bioreactors, they often fall short when it comes to crafting food that truly appeals to consumers. This is where established food companies step in, using their deep knowledge of flavour chemistry, texture, and sensory science to turn Cultivated Meat into something that feels right at home on supermarket shelves alongside traditional options.

The collaboration between tech innovation and food industry expertise is crucial for moving Cultivated Meat out of the lab and into everyday meals.

Matching Consumer Taste Expectations

Food companies play a key role in ensuring Cultivated Meat meets consumer expectations for taste, texture, and appearance. ADM, with its 50 years of experience in plant-based proteins, highlights the sensory science expertise these companies bring to the table [15].

Take Ivy Farm Technologies, for example. They partnered with Finnebrogue to access premium Wagyu and Aberdeen Angus cell lines. Finnebrogue’s conventional Wagyu burgers were even voted the top pick in a 2022 Which? magazine taste test [1]. Ivy Farm’s CEO, Rich Dillon, explained:

"In Finnebrogue we have found a partner who has a long history and track record of producing premium products that do not compromise on taste and quality." [2]

There’s also a growing trend of hybrid products that combine cultivated cells with plant-based proteins. These not only improve texture but also help lower production costs. Leticia Gonçalves, President of Global Foods at ADM, pointed out:

"They don't want to just replicate animal meat today. They want options with better nutritional profiles, better sustainability and affordability." [15]

With around 50% of consumers identifying as flexitarians [15], this approach resonates with a market segment already open to exploring alternative protein sources.

But it’s not just about taste and texture - food companies also bring the expertise needed to scale production and make Cultivated Meat a commercially viable option.

Scaling Production Systems

Scaling up production requires more than just technology - it demands strong infrastructure, efficient supply chains, and manufacturing know-how to hit industrial volumes and competitive pricing.

In March 2023, Mosa Meat partnered with Nutreco, a leader in animal nutrition, to develop a cost-effective cell feed supply chain. By transitioning from pricey pharma-grade ingredients to affordable food-grade alternatives, they aim to lower production costs [17]. Similarly, Believer Meats teamed up with GEA in 2023 to co-develop technologies that improve both cost efficiency and sustainability [17]. Gustavo Burger, CEO of Believer Meats, shared:

"Partnering with ADM will give us access not only to co-development of products, but their deep knowledge about texture, taste, and nutrition." [15]

These collaborations are already delivering results. Believer Meats’ pilot plant in Israel currently produces 500 kilograms of Cultivated Meat daily, and its North Carolina facility under construction is set to produce 12,000 tonnes annually [16]. Meanwhile, SuperMeat has achieved cost parity with premium pasture-raised chicken in the U.S., producing 100% Cultivated Chicken for about £9.43 per pound [17].

In early 2026, Nutreco, Fork & Good, and Extracellular announced a strategic partnership aimed at creating a cost-efficient scale-up ecosystem for cultivated red meat. Jon Lee, Bioprocess Director at Fork & Good, explained:

"By working together to solve shared challenges, we significantly de-risk manufacturing not only for Fork & Good, but for producers and vendors across the entire sector." [7]

These partnerships highlight how the manufacturing expertise of food companies is accelerating the journey toward commercial viability, paving the way for Cultivated Meat to become a mainstream option.

sbb-itb-c323ed3

Examples of Food-Tech Partnerships

Partnerships Solving Production Challenges

Collaborations in food-tech are playing a critical role in overcoming production challenges in the Cultivated Meat industry. For instance, in February 2025, Ever After Foods teamed up with Bühler to scale up production using their patented edible packed-bed technology. This innovation has enabled a dramatic boost in reactor efficiency, producing over 80kg of Cultivated Meat from a 200-litre reactor - compared to the mere 4–8kg achieved with conventional pharmaceutical-grade methods [13]. Eyal Rosenthal, CEO of Ever After Foods, highlighted the issue:

"Existing equipment and solutions from the biotechnology and pharmaceutical industries are not suitable for the food industry and cannot scale to meet the demands of cultivated meat production." [13]

In another key partnership, Meatable joined forces with TruMeat in April 2025 to establish Singapore's first commercial-scale facility. Using a continuous perfusion process, the facility is designed to produce Cultivated Meat at costs and volumes that enable commercial partners to test and launch their products [18][4]. Jeff Tripician, CEO of Meatable, shared his thoughts on the collaboration:

"This collaboration brings us closer to providing the meat industry with the solutions it needs to deliver great tasting, sustainable meat to customers and consumers worldwide." [18]

Earlier, in January 2024, Quest Meat partnered with the University of Birmingham on a £520,000 R&D project, co-funded by Innovate UK. This initiative focuses on advancing NEUTRIX, an edible scaffolding, and NEUSOL, a low-cost soluble media supplement, aimed at improving consistency and cutting manufacturing costs [3].

These partnerships are not just about technological advancements - they lay the groundwork for bringing Cultivated Meat closer to consumers.

How Cultivated Meat Shop Supports Market Adoption

While production-focused partnerships address manufacturing challenges, consumer engagement is equally vital to market success. Cultivated Meat Shop serves as a bridge between innovation and market readiness, acting as an educational platform for curious shoppers. It offers product previews, waitlist sign-ups, and regular updates on industry progress, helping to prepare UK consumers for the introduction of Cultivated Meat products. By aligning technical solutions with consumer awareness, the industry is steadily building the foundation for widespread adoption.

What's Next for Food-Tech Collaboration

Market Availability and Affordability

The outlook for Cultivated Meat in the UK is becoming more promising, thanks to food-tech partnerships that are helping to reduce costs and accelerate regulatory approvals. Industry predictions indicate that by 2025–2030, the price of Cultivated Meat could match that of premium conventional meat, with broader cost parity expected by 2030–2035 [5].

Regulatory developments are also playing a key role. In March 2025, the UK Food Standards Agency (FSA) launched a two-year regulatory sandbox involving eight companies, including Hoxton Farms and Mosa Meat. This initiative aims to complete safety assessments for at least two Cultivated Meat products by 2027. Science Minister Lord Vallance highlighted the wider implications of this effort:

"This work will not only help bring new products to market faster, but strengthen consumer trust, supporting our Plan for Change and creating new economic opportunities across the country." [19]

Efforts to streamline the supply chain are tackling cost challenges head-on. Strategic partnerships between companies like Nutreco (an ingredient specialist), Extracellular (a biomanufacturing infrastructure provider), and Fork & Good (a B2B meat developer) are focusing on improving media manufacturing, which is the biggest cost factor in production [7]. Jon Lee, Bioprocess Director at Fork & Good, explained the importance of these collaborations:

"This type of partnership is exactly what the cultivated meat industry needs to accelerate progress toward a viable commercial process. By working together to solve shared challenges, we significantly de-risk manufacturing." [7]

These developments are not just about reducing costs - they are also laying the groundwork for a market that is ready to embrace Cultivated Meat. With these logistical hurdles being addressed, the focus is now shifting towards educating consumers.

Preparing Consumers Through Education

As production and regulatory challenges are tackled, consumer education has become essential for the success of Cultivated Meat. Platforms like Cultivated Meat Shop are stepping up to inform UK consumers about what Cultivated Meat is, how it’s made, and why it matters. By offering sneak peeks at products, waitlist sign-ups, and clear information on safety and environmental benefits, these platforms bridge the gap between technological advancements and everyday purchasing decisions.

Professor Robin May, Chief Scientific Advisor at the FSA, highlighted the importance of public trust in this process:

"By prioritising consumer safety and making sure new foods, like CCPs are safe, we can support growth in innovative sectors. Our aim is to ultimately provide consumers with a wider choice of new food." [19]

Early adopters will be crucial in shaping public opinion, providing feedback to refine products before they hit supermarket shelves. As Cultivated Meat transitions from niche restaurant offerings to mainstream availability, clear communication and accessible information will play a major role in helping consumers see it as a practical, safe, and sustainable alternative to traditional meat.

Conclusion

The food industry is on the brink of a major shift, driven by advancements in technology and strategic collaborations.

Partnerships between food companies and tech innovators have transformed Cultivated Meat from an expensive lab experiment into a practical alternative to traditional meat. By merging the scientific know-how of startups with the large-scale production and distribution capabilities of established food brands, these collaborations have significantly reduced costs since 2013 [5][6].

These partnerships do more than just lower expenses - they lay the groundwork for broader acceptance. When well-known brands like Finnebrogue team up with pioneers like Ivy Farm Technologies, they bring a level of trust that helps ease consumer concerns about adopting unfamiliar food technologies. Established names associated with quality and safety lend credibility to Cultivated Meat, making it more approachable for sceptical buyers [6].

With production hurdles largely addressed and costs becoming more manageable, the next big challenge is educating consumers. As regulatory systems evolve and manufacturing scales up, raising awareness is essential. Platforms such as Cultivated Meat Shop play a key role in this process, providing UK consumers with straightforward explanations about how Cultivated Meat is made, what it offers, and why it matters. Through previews, waitlist options, and accessible information, these platforms help bridge the gap between innovation and everyday dining.

The future of Cultivated Meat depends on consumers who understand its science and benefits. With production challenges tackled through partnerships and consumer education gaining momentum, Cultivated Meat is well on its way to becoming a regular feature on British dinner tables - a natural progression from traditional meat.

FAQs

How are food and tech companies working together to make cultivated meat more affordable?

Food and tech companies are working together to make cultivated meat more affordable. Their main focus? Scaling up production, improving processes, and cutting costs - all while keeping quality intact.

Take, for instance, efforts to swap out pricey pharma-grade ingredients for food-grade alternatives. This simple change can slash costs without compromising the end product. Other partnerships are pouring resources into advanced bioreactors, automation, and smarter supply chain solutions, all aimed at ramping up large-scale production.

These initiatives are further bolstered by shared research projects and government funding, bringing cultivated meat one step closer to becoming an affordable and accessible option for everyone.

What is the role of bioreactors in cultivated meat production?

Bioreactors play a crucial role in the production of cultivated meat by providing a controlled environment where animal cells can thrive and multiply. These systems carefully manage variables like temperature, oxygen, and nutrient levels to maintain ideal conditions for cell growth.

By supporting large-scale cell cultivation, bioreactors enable the production of cultivated meat in quantities suitable for commercial purposes. They are pivotal in making this forward-thinking food option more accessible and scalable for the future.

Why is animal-free growth media important for cultivated meat, and how is it developed?

Animal-free growth media are designed to provide the nutrients needed for cultivated meat cells to grow and multiply, without relying on animal-derived components like fetal bovine serum (FBS). These media are carefully formulated with a combination of sugars, amino acids, salts, vitamins, and growth factors to support the growth and development of cells.

Switching to animal-free media is important for several reasons. Traditional options not only come with high costs but also depend on animal products, raising ethical concerns. To address these issues, recent efforts have focused on developing food-grade alternatives that are more affordable and scalable. These advancements are essential for making cultivated meat a more accessible and sustainable option in the future.