Economies of scale are helping cultivated meat become more affordable by reducing production costs significantly. Currently, costs range from £12.50 to over £315,000 per kilogram, depending on the scale and technology used. Scaling up production, automation, and better supply chains are driving these costs down. For example:

- Larger facilities: Bigger bioreactors (up to 100,000 litres) cut costs per kilogram by spreading fixed expenses over higher output.

- Automation: Reducing labour costs (30% of production expenses) by up to 20% while improving efficiency.

- Supply chains: Switching to food-grade ingredients can lower costs by up to 100 times.

Advances like serum-free growth media and continuous production systems are also slashing costs. For instance, some companies have reduced growth media expenses to as low as £0.17 per litre. Experts predict cultivated meat could match conventional meat prices by the early 2030s, with production costs dropping to around £4.90 per pound for chicken.

While challenges like high growth media costs, bioreactor scalability, and regulatory hurdles remain, the UK government’s £30 million investment and updated regulatory frameworks aim to support this industry. Cultivated meat offers potential benefits like reduced emissions, lower land use, and improved food security, making it a promising alternative for the future.

Main Factors That Reduce Cultivated Meat Costs

Reducing the cost of cultivated meat hinges on scaling up production, automating processes, and streamlining supply chains.

Larger Facilities and Bigger Bioreactors

The size of production facilities and bioreactors plays a major role in lowering the cost of cultivated meat. Larger bioreactors are more economical because the cost per litre of capacity decreases as the bioreactor size increases. This allows fixed expenses to be spread over a much larger output [8].

Currently, industrial bioreactors can handle up to 25,000 litres, but companies are already planning for much larger systems. Upside Foods, for instance, intends to use 100,000-litre bioreactors at its upcoming facility near Chicago, aiming for an annual production of 13,000 tonnes of meat [5]. Scaling up bioreactor size can significantly cut costs. For example, increasing production scale by tenfold could reduce total upstream depreciation costs per pound by 65% [8]. A techno-economic analysis suggests that producing cultivated chicken in a 50,000-litre facility could bring costs down to approximately £4.73 per pound (around £10.43 per kilogram) [7].

These larger systems provide a foundation for further cost reductions through automation and improved supply chain management.

Automation and Reduced Labour Costs

Automation is another key factor in driving down costs. Labour, which often accounts for around 30% of cultivated meat production expenses, includes salaries for skilled technicians and research scientists [10]. By automating key processes, companies can reduce these labour costs by up to 20% [10].

Beyond cost savings, automation offers other benefits such as improved product consistency, fewer errors, enhanced worker safety, and better asset utilisation by minimising downtime [9]. For example, Tyson’s computer vision system for poultry inventory tracking has achieved 20% greater accuracy compared to manual methods [9]. For cultivated meat companies, investing in automation tools that learn and adapt over time can reduce waste and improve yields. This is particularly crucial since bioreactor maintenance alone can account for up to 30% of overall lab operating costs [10].

Better Supply Chain Management

Scaling up production also enables companies to negotiate better deals on raw materials and optimise supply chains. Key ingredients like sugar, minerals, amino acids, and growth factors are essential for cultivated meat production. Switching from pharmaceutical-grade to food-grade ingredients can slash costs by up to 100 times without sacrificing yield [5].

This shift is critical because amino acids are expected to make up more than half the cost of growth media at scale, according to researchers at the University of California, Davis [5].

"Feeding cells isn't that different from feeding animals."

– Susanne Wiegel, Head of the Alternative Protein Programme at Nutreco [5]

Efforts to build cost-effective supply chains are already underway. Kevin Kayser, Chief Scientific Officer at Upside Foods, highlighted the focus on raw material inputs:

"One of the reasons I was hired was raw material inputs" [5]

Meanwhile, Elliot Swartz from the Good Food Institute added:

"Amino acids are next on the chopping block" [5]

Studies suggest that media costs could drop to less than £0.19 per litre using current technologies [6]. As the industry scales up, leveraging bulk purchasing agreements and improved logistics will further reduce the cost of consumables, which can make up 30% of operating expenses [10]. Building a robust supply chain for low-cost growth media now is crucial for future large-scale production [5].

Technology Advances That Enable Cost Savings

Advancements in technology are driving down costs in cultivated meat production by addressing major expense drivers, such as costly growth media and inefficient production methods. These innovations build on earlier improvements in scalability, automation, and supply chain processes.

Animal-Free Growth Media

One of the most impactful developments in cultivated meat production is the creation of animal-free growth media. Traditionally, cell culture has relied on fetal bovine serum (FBS), a costly, ethically controversial ingredient that also poses regulatory challenges. Serum-free media currently accounts for at least 50% of variable operating costs in cultivated meat manufacturing due to the expense of growth factors and recombinant proteins [3].

Switching to food-grade ingredients has significantly reduced these costs. For instance, Liz Specht's analysis found that replacing basal medium components with bulk, food-grade alternatives could cut basal media costs by 77% [3]. On average, food-grade components are 82% cheaper than their reagent-grade counterparts when purchased at a scale of 1 kg [3].

Some notable achievements include:

- Believer Meats: Developed a serum-free medium costing as little as $0.63 (£0.50) per litre [3].

- Meatly: Created a protein-free culture medium, reducing costs to just £1 per litre [11].

"Our protein-free culture medium represents a critical milestone for us and the wider cultivated meat industry. By setting this new benchmark, we are driving the cost of production down significantly, which is something the industry has been grappling with for years."

– Helder Cruz, Co-founder and Chief Scientific Officer, Meatly [11]

Jim Mellon, founder of Agronomics, highlighted the importance of this progress:

"Meatly has single-handedly slashed those costs a hundredfold or more. This is a huge step forward in bringing the cost of cultivated meat to price parity with conventional meat and, ultimately, toward the mass adoption of cultivated products." [11]

Collaborations have proven the effectiveness of these cost reductions at scale. For example, Mosa Meat partnered with Nutreco to replace 99.2% of basal cell feed by weight with food-grade components while maintaining cell growth comparable to pharmaceutical-grade media [3]. Similarly, Nutreco and Blue Nalu demonstrated that food-grade media supported growth as effectively as pharmaceutical-grade alternatives for muscle-derived bluefin tuna cells [3].

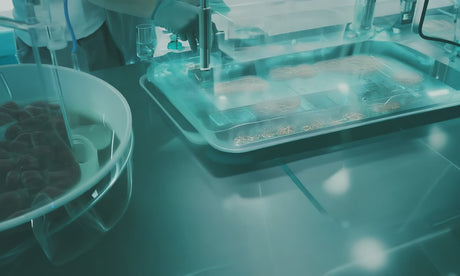

Continuous Production Systems

Traditional batch production methods require frequent pauses for cleaning and preparation, leading to inefficiencies and downtime. Continuous production systems address this by keeping reactors in a steady state, enabling ongoing harvesting and feeding without interruptions [13].

The benefits are striking. Continuous systems can boost cell mass yield by up to fourfold per reactor volume, with some high-performance setups achieving up to tenfold increases [13]. These gains translate to lower production costs per kilogram of meat.

In August 2024, Professor Yaakov Nahmias of the Hebrew University of Jerusalem showcased the potential of continuous manufacturing using tangential flow filtration (TFF). His process achieved biomass expansion to 130 billion cells per litre, with yields of 43% weight per volume. The system operated continuously for 20 days, allowing daily biomass harvests [7].

A techno-economic analysis of a hypothetical 50,000-litre facility suggested that cultivated chicken production costs could drop to $6.20 (£4.91) per pound, aligning with the price of organic chicken [7].

"We were inspired by how Ford's automated assembly line revolutionised the car industry 110 years ago. Our findings show that continuous manufacturing enables cultivated meat production at a fraction of current costs, without resorting to genetic modification or mega-factories. This technology brings us closer to making cultivated meat a viable and sustainable alternative to traditional animal farming."

– Prof. Yaakov Nahmias, Founder of Believer Meats [7]

Gourmey has also advanced continuous production, claiming its 5,000-litre bioreactor system can achieve costs as low as $3.43 (£2.72) per pound [12]. Their model delivers a production cost of €7/kg (£5.88/kg) at current scale, with continuous runs achieving high cell density and cell feed costs of just €0.20/L (£0.17/L), all without growth factors or FBS [12].

Improved Bioreactor Design

The design of bioreactors plays a crucial role in reducing both equipment and operational costs. Historically, the industry has relied on pharmaceutical-grade bioreactors, which are expensive and often over-engineered for food production.

Now, companies are focusing on bioreactors specifically designed for cultivated meat production. These include stirred-tank and air-lift bioreactors, operated in fed-batch or continuous modes. Strategies like recycling and filtration further optimise performance [4]. Purpose-built bioreactors and auxiliary tools, such as cell retention devices, can significantly enhance efficiency [4].

Performance improvements are another key factor. Yields in cultivated meat production range from 5-10 g/L to as high as 300-360 g/L, depending on the bioprocess design, cell type, media formulation, and reactor type [4]. Higher yields mean more meat from the same equipment, reducing costs per kilogram.

Together, these technological advancements are driving down production costs while maintaining quality and safety standards. Combined with earlier scaling benefits, they are bringing cultivated meat closer to competing with conventional meat in terms of price.

sbb-itb-c323ed3

Barriers to Matching Conventional Meat Prices

Achieving cost parity with conventional meat remains a significant challenge for the cultivated meat industry. While progress is being made, several key hurdles still need to be addressed. These include high costs associated with growth media, the need for larger bioreactor capacities, and regulatory as well as infrastructure limitations.

High Growth Media Costs

Growth media is the single most expensive component of cultivated meat production, accounting for at least 50% of variable operating costs [3]. For instance, in Essential 8 medium, 98% of the cost comes from FGF-2 and TGF-β growth factors [3]. Similarly, in Beefy-9 medium, albumin, FGF-2, and insulin collectively make up about 60% of the total media costs [3]. Across the board, manufacturers report that growth factors constitute 60–80% of their current medium expenses [14].

These growth factors come with a hefty price tag, ranging from £3.17 to £317,000 per gram. However, forecasts suggest that within five years, this could drop to between £0.79 and £79 per gram [14]. Encouragingly, 33% of manufacturers anticipate sourcing their complete medium ingredients for less than £0.79 per litre within the next year [14].

To address these costs, the industry is exploring several strategies:

-

Using food-grade components: Switching to food-grade materials can deliver immediate savings, as they are on average 82% cheaper than pharmaceutical-grade alternatives at a 1kg scale [3]. Susanne Wiegel from Nutreco highlights the potential here:

"We need to look at how animal feed is done. The majority of nutrients are provided through agricultural crops." [5]

- Reducing reliance on growth factors: Genetic engineering of cell lines, plant-based substitutes, and recycling techniques are being developed to minimise dependency on costly growth factors [14].

- Media recycling and optimisation: By reusing media components and preventing the accumulation of toxic metabolites, companies can significantly lower waste and maximise the value extracted from each litre of media [3].

Need for Larger Bioreactor Capacity

Scaling up production introduces another set of challenges. Current facilities aim for an average yearly output of around 136,000kg by 2027 [15], but projections suggest the cultivated meat market could grow to between 400,000 and 2.1 million tonnes by 2030 [4]. Achieving this scale requires substantial investment in bioreactors, typically in the 10,000–50,000-litre range [4].

However, scaling up isn’t straightforward:

-

Cell productivity issues: Each cell type and product has unique needs, making it difficult to find a one-size-fits-all solution for scaling. As industry experts note:

"Due to the specific requirements of each cell type and product, a universal bioprocess and scaling solution may not be feasible. Consequently, there's a demand for additional techno-economic models and experimental data to fine-tune bioprocesses for each specific product type." [4]

- High equipment costs: Building facilities capable of producing 121,000 tonnes annually could require capital investments of £1.57 billion to £10.6 billion [2].

- Clean room requirements: Clean rooms add significant expense but may not always be necessary. Experts suggest that closed processing systems could replace costly clean rooms for upstream processes, reducing facility costs [15].

These challenges are further complicated by regulatory and infrastructure constraints.

Regulatory and Infrastructure Barriers

The UK's regulatory framework, still aligned with EU novel food regulations, presents hurdles that slow innovation and cost reduction [17]. Additionally, the lack of large-scale production facilities in the UK forces companies to seek opportunities abroad, which delays domestic growth and affects investor confidence [2].

Consumer acceptance also poses a challenge. Surveys reveal that only 16-41% of UK consumers are currently open to eating cultivated meat, while 46% believe it shouldn’t be sold in the UK [2]. This hesitancy impacts market potential and investment.

However, there are signs of progress. The Food Standards Agency (FSA) is working to modernise the approval process. Professor Robin May, the FSA’s chief scientist, explained:

"We're designing a framework that supports innovation without compromising rigour." [18]

Lord Vallance has also highlighted the importance of cultivated meat technology:

"This isn't about replacing the farm with the lab. It's about expanding our toolkit to feed a changing world." [18]

The UK government is actively working to streamline cultivated meat approvals as part of its strategy to enhance food security and provide alternative protein sources [16]. In 2022, British startups raised £61 million in funding - more than the rest of Europe combined (£45 million) [16]. These efforts, alongside the FSA’s updated processes, aim to clear the regulatory path, enabling the industry to benefit from cost reductions achieved through scaling.

Future of Affordable Cultivated Meat in the UK

The journey toward making cultivated meat affordable in the UK is gaining momentum. Advances in technology, reductions in production costs, and growing government backing are paving the way for cultivated meat to become a viable alternative to traditional options. Below, we explore how the industry is addressing cost challenges and moving closer to affordability.

When Cultivated Meat Might Match Conventional Prices

Experts predict that cultivated meat could match the price of traditional meat by the early 2030s, thanks to major cost reductions [1]. A standout example is Meatly, which has reduced the cost of its growth medium by 80%, bringing it down to £0.22 per litre. With further scaling, this cost could drop to as low as 1.5p per litre [19]. Meatly has also developed a 320-litre bioreactor priced at just £12,500 - a fraction of the £250,000 typically seen in the biopharma industry [19].

"We are proving critics wrong by nearing price parity... By reaching price parity, it then becomes a simple and easy choice for consumers to buy better meat for their pets." – Helder Cruz, Meatly's Chief Scientific Officer [19]

"By setting a new cost benchmark, we're addressing one of the industry's most persistent challenges – bringing production costs down to make cultivated meat commercially viable and reach price parity with traditional products." – Owen Ensor, Meatly co-founder and CEO [20]

In terms of specific products, research shows that cultivated chicken could be produced for around £4.90 per pound using methods like tangential flow filtration and animal-free serum [21]. Additionally, a report by BCG estimates that by 2035, cultivated meat could account for 6% of the global alternative protein market [1].

Benefits Beyond Lower Costs

Affordable cultivated meat offers more than just savings - it could significantly reduce the environmental strain of livestock farming, which currently contributes 14% of global greenhouse gas emissions [1]. Compared to traditional European beef, cultivated meat uses 45% less energy, and when produced with renewable energy, it can cut greenhouse gas emissions by up to 92%, while using 95% less land and 78% less water [1].

It also addresses ethical concerns around animal welfare. A 2025 Ipsos survey revealed that 33% of British adults see avoiding animal slaughter as the main benefit of cultivated meat, while 21% value its eco-friendliness [22]. Economically, the sector holds immense potential, generating £2.70 of value for every £1 spent on cultivated meat [1]. By 2030, it could contribute £523 million in tax revenue and add £2.1 billion to the UK economy [24], while also strengthening food security and reducing dependency on imports [23].

How Cultivated Meat Shop Prepares Consumers

As cultivated meat nears cost parity and technological challenges are addressed, educating consumers becomes critical. Cultivated Meat Shop is playing a key role in closing the knowledge gap. Peter Cooper, Director of Global Omnibus Services at Ipsos, highlighted the importance of shaping public perception early:

"Our Ipsos Observer UK research suggests there is a genuine potential growth market for cultivated meat in Britain, in particular among younger people. With limited knowledge about cultivated, or 'lab grown' meat, there is a chance for producers to shape perceptions before it's done for them. That being said, consumers do still have some concerns, in particular around the unclear long-term health impacts of cultivated meat. This will need to be addressed for perceived environmental upsides to be realised." [22]

Cultivated Meat Shop tackles these concerns by offering science-based content that explains how cultivated meat is made, its benefits, and how it compares to conventional options. Transparency in production processes builds trust, especially among sceptical consumers. For instance, while 47% of Generation Z express willingness to try cultivated meat, only 21% of Baby Boomers feel the same. Concerns about long-term health impacts (48%) and perceptions of it being unnatural (42%) remain barriers [22].

To foster interest and confidence, Cultivated Meat Shop provides waitlist sign-ups, product sneak peeks, and regular updates. By creating a community of informed early adopters, the platform is helping to pave the way in a market where 34% of UK consumers are open to trying cultivated meat [24].

FAQs

How does scaling up production help make cultivated meat more affordable?

Scaling up production is a game changer for reducing the cost of cultivated meat. By increasing output, the per-unit expense of key components like cell culture media and growth factors drops significantly. Larger facilities have the added advantage of buying raw materials - such as glucose and media - in bulk, which naturally brings costs down. On top of that, scaling up allows for more efficient processes, with automation and advanced techniques cutting down on labour and operational expenses.

Another key factor is investment in larger-scale manufacturing and streamlined supply chains. These improvements not only lower costs but also make cultivated meat more accessible to consumers. This progress could help usher in a more ethical and sustainable food system, both in the UK and beyond.

What technological advancements are helping to reduce the cost of cultivated meat?

Technological progress is steadily helping to bring down the cost of cultivated meat. One major factor is the introduction of larger production facilities, which benefit from economies of scale. Alongside this, advanced automation technologies are making manufacturing more efficient by cutting labour costs and streamlining processes.

Another game-changer lies in the supply chain, particularly in refining the production of growth media - the nutrients essential for cell cultivation. By improving how resources are used and scaling up operations, cultivated meat is becoming a more affordable and accessible protein option for consumers in the UK and beyond.

What are the main challenges in making cultivated meat as affordable as traditional meat?

The cultivated meat industry is grappling with the challenge of bringing down costs to compete with traditional meat. One major issue is the high production expense, which is largely due to small-scale processes that haven't yet been adapted for large-scale manufacturing. On top of that, scaling up presents its own set of technical obstacles, such as enhancing cell culture media, improving automation systems, and maintaining consistent product quality.

Reaching a point where large-scale production becomes affordable is a critical step towards achieving price parity with conventional meat. Progress in areas like facility design, streamlining supply chains, and introducing better technology will be key to reducing costs and turning cultivated meat into a commercially viable, sustainable option.